If you find any info from this article confusing, write a comment, and I’ll help you out as soon as possible.

EXCEL EXTRA PAYMENT MORTGAGE CALCULATOR HOW TO

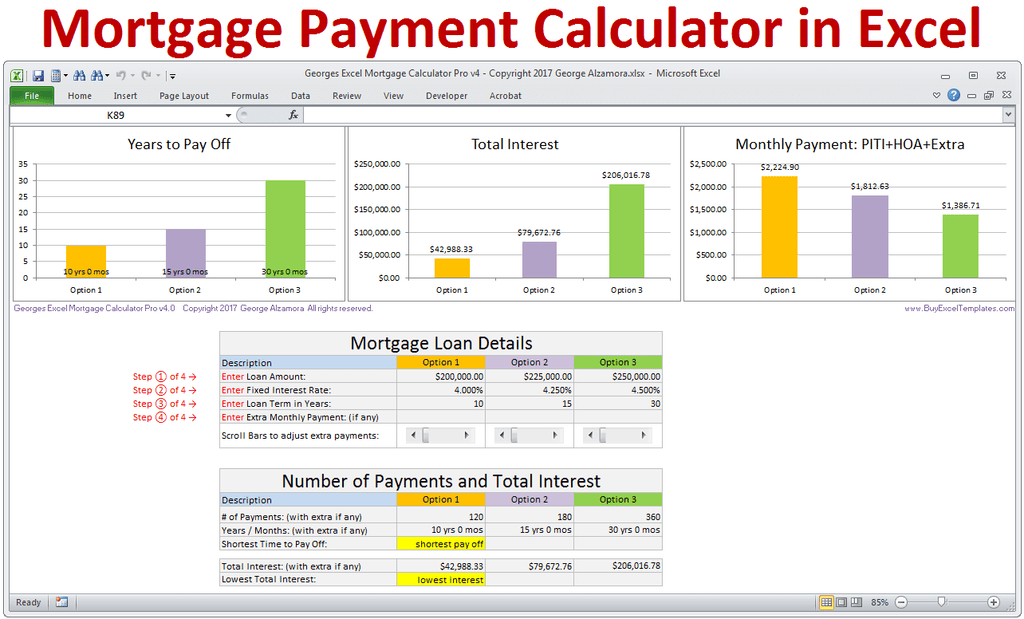

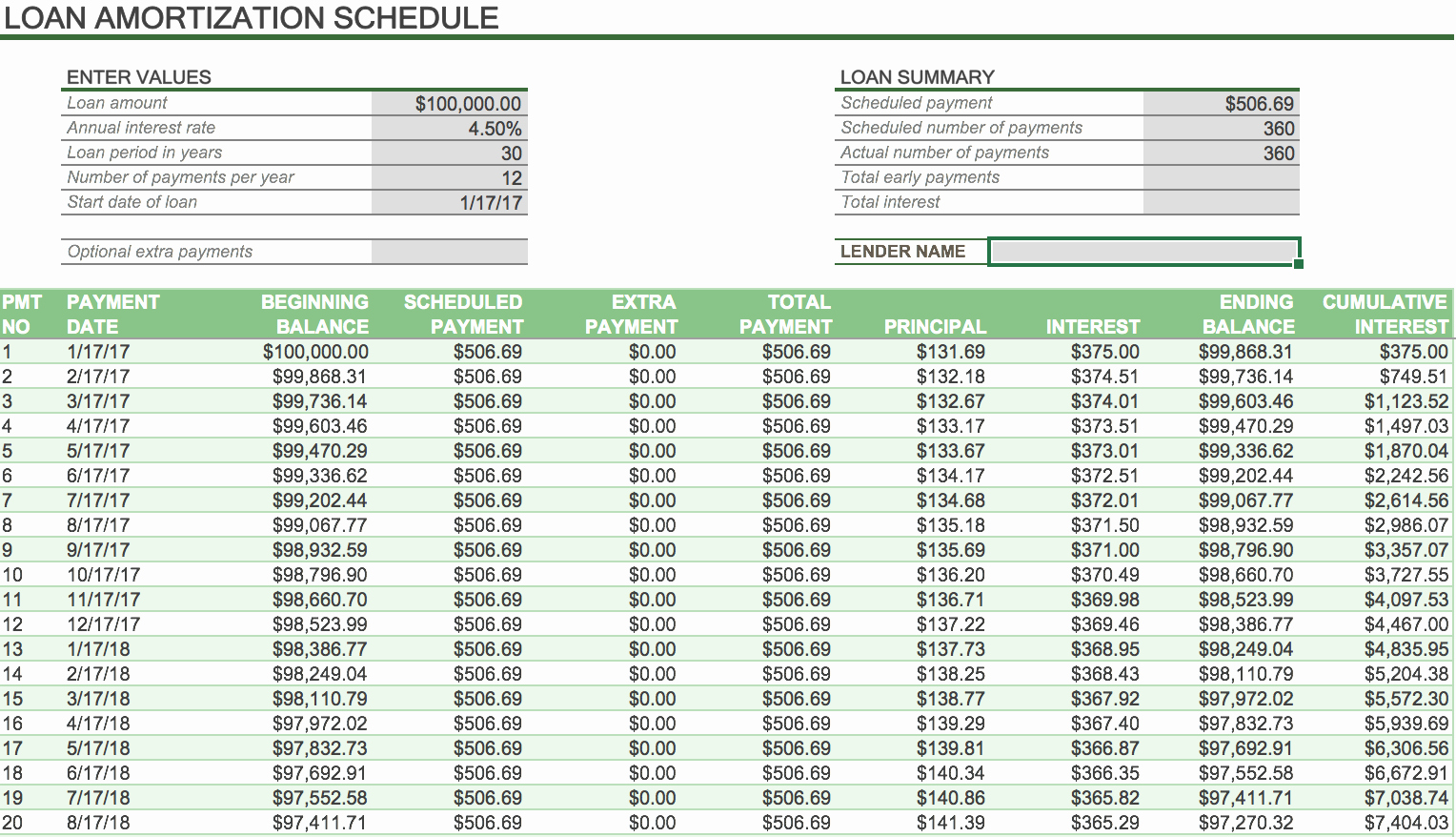

In one of my next articles, I will also teach you how to create a loan amortization schedule in Excel. Simply change the term of the loan and the down payment, and you should be good to go. The formulas from this Excel tutorial can be adjusted to also work for a personal loan with equal installments. the amounts returned by PPMT and IPMT are different based on the period number What to do next?.if your loan term is expressed in years and the payments are made monthly, make sure to multiply the loan period by 12.if your payments are made monthly, make sure to divide the annual rate by 12.use the negative sign to convert the result to a positive number.be consistent when setting your arguments.There are a few things to watch out for when working with Excel functions like PMT, PPMT, or IPMT: Things to remember when you calculate monthly payments Note: the PMT function works only for a fixed-rate mortgage. type = 0 or can be omitted (by default, the type argument is set to zero).Account for interest rates and break down payments in an easy to use amortization schedule.

EXCEL EXTRA PAYMENT MORTGAGE CALCULATOR FREE

To calculate the monthly payments, I have used the following arguments for the PMT function: Finally, we insert the principal borrowed (the difference between the cost of the house and the down payment). Annual interest rate / 12 monthly interest rate. Step 1: Convert the annual interest rate to a monthly rate by dividing it by 12. For the interest rate, we use the monthly rate (annual rate divided by 12), then we calculate the number of periods (360 months which is 30 years multiplied by 12 months). Our amortization calculator will do the math for you, using the following amortization formula to calculate the monthly interest payment, principal payment and outstanding loan balance. The minus sign before the PMT function is needed since the formula returns a negative number. The formula, as shown above, is written in the following order: Online Canadian Mortgage Payment Calculator - by CanEquity.Using the annual interest rate, the principal, and the loan term, we determine the sum to be paid monthly.There are many other great calculators on this site, also. Mortgage Calculators : Provides a formula for converting between Canadian and US mortgage rates.A Guide to Mortgage Interest Calculations in Canada at : Includes some Excel spreadsheets!.Canada Mortgage and Housing Corporation : Contains a lot of excellent material and guides for buying and selling homes in Canada, such as information about CMHC Mortgage Loan Insurance.Please note the disclaimer, and report any errors you may find in our spreadsheet. Our spreadsheet DOES round, and it also adjusts the last payment to bring the balance to zero. Keep in mind that some online calculators do not round the payment and interest to the nearest cent, so if you see a small discrepancy in the calculations, this is likely the issue.

We used a number of different online calculators to verify this spreadsheet. The normal weekly payment would be $134.00, so the extra payment would be 145.40-134.00= 11.40.Īnother way to estimate the effect of making one extra monthly payment each year is to choose the Monthly option in the Payment Frequency and set the Extra Payment equal to payment/12. A normal bi-weekly payment, found by setting the Payment Frequency to bi-weekly, would be $268.14 rounded.Īccelerated Weekly plans are similar, but each weekly payment would be 1/4 of 581.60 or $145.40. There are 26 bi-weekly payments in a year so the difference between 581.60*12 and 581.60/2*26 is 581.60, or one extra monthly payment per year. In an Accelerated Bi-weekly plan, each bi-weekly payment would be 1/2 of 581.60 or $290.80. The total payments for the year would be 7560.80. The result is that by the end of a year you will have paid the equivalent of one extra monthly payment towards the principal.Įxample: A 100,000 mortgage at 5% interest, compounded semi-annually, with an amortization period of 25 years, results in a monthly PI (principal + interest) payment of $581.60 (rounded). By tradition, the "accelerated bi-weekly" payment is defined as 1/2 a normal monthly payment. The first thing to realize is that "accelerated" means that rather than a normal bi-weekly payment, you are also making an extra payment on the principal. This calculator allows you to analyze the effect of an Accelerated Bi-Weekly payment plan, a common type of mortgage repayment plan.

0 kommentar(er)

0 kommentar(er)